Resolution Center

Managing disputes with Operate

Dispute Process Overview

When a customer experiences a problem with their order and requests a refund, a dispute may arise. Lenders can report the dispute with the relevant information regarding the order.

Once a dispute is submitted, merchants are assigned the case in the Resolution Center to provide any additional information and supporting documentation that will help resolve the case.

Lenders will then analyze the information provided and settle the dispute case either in the consumer’s or the merchant’s favor.

Key Steps

- Dispute Creation: Lenders can create dispute cases when a consumer requests a refund or reports an issue.

- Case Assignment: Disputes are assigned to merchants for additional information and resolution.

- Information Submission: Merchants submit supporting documentation and details to help resolve disputes.

- Resolution: Lenders analyze the information provided and settle the dispute in favor of either the consumer or the merchant.

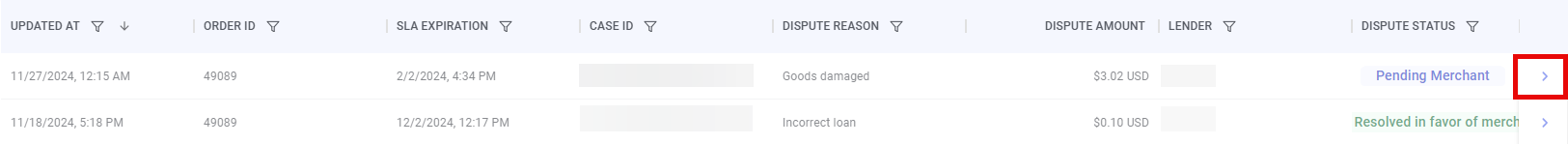

Disputes List

The Resolution Center presents the Disputes List with the following fields:

- UPDATED AT: Timestamp of the most recent update to the dispute.

- ORDER ID: The unique identifier of the order or charge.

- SLA EXPIRATION: The timeframe in which the merchant can resolve the issue. Once the Service Level Agreement expires, an indication will be shown in the table and in the Case Details view.

- CASE ID: The unique identifier of the dispute created by ChargeAfter.

- DISPUTE REASON: The reason why the dispute was created. Possible reasons:

- Cancelled by user: The consumer cancelled the purchase according to the cancellation policy.

- Goods damaged: The consumer received damaged goods.

- Goods never received: The consumer did not receive the goods.

- Goods not as expected: The consumer received goods that did not meet their expectations.

- Goods returned: The consumer returned the goods according to the return policy.

- Incorrect amount: The consumer was charged or refunded an incorrect amount.

- Incorrect loan: The consumer does not recognize the loan.

- Other: Any other reason not mentioned above.

- DISPUTE AMOUNT: The total monetary value of the dispute.

- LENDER: The name of the lender.

- DISPUTE STATUS: The current status of the dispute. Possible statuses:

- Pending Lender: The dispute is assigned to the lender for review.

- Pending Merchant: The dispute is assigned to the merchant.

- Resolved in Favor of Merchant: The dispute was resolved in favor of the merchant.

- Cancelled: The dispute was cancelled by the consumer.

- Approved: The dispute was approved by the lender.

- Partially Approved: The dispute was partially approved by the lender, and a partial chargeback is issued.

- CREATED AT: Timestamp of when the dispute was created.

- DESCRIPTION: Any additional details included in the dispute description.

Dispute Details

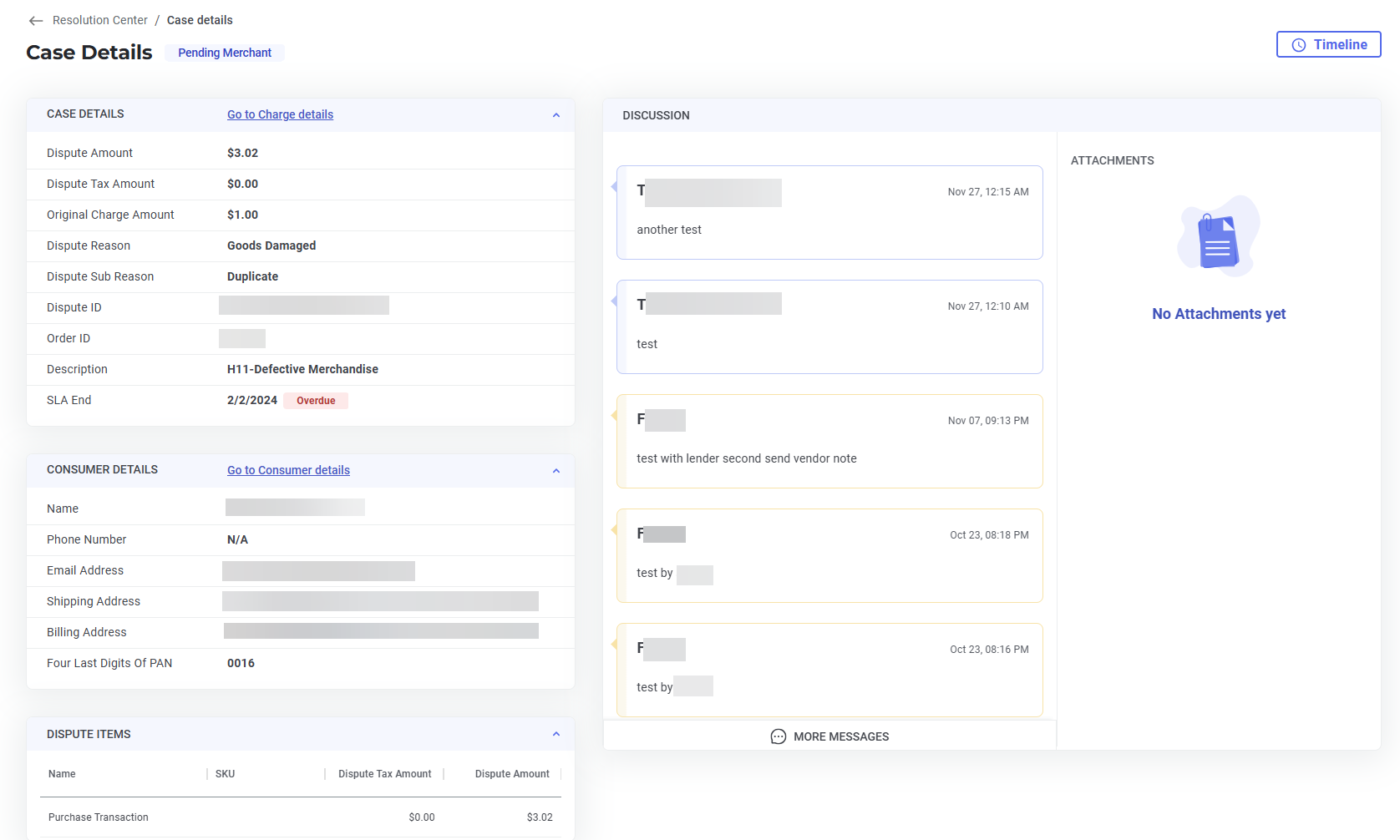

To open details of a dispute, click the arrow to the far right of the dispute's row in the Disputes List.

The Dispute Details are displayed as follows:

- Dispute Status: Displayed at the top of the page.

- Case Details: Click the link to go to the charge details in the Charges module or view the following:

- Dispute Amount

- Dispute Tax Amount

- Original Charge Amount

- Dispute Reason

- Dispute Sub Reason

- Dispute ID

- Order ID

- Description

- SLA End

- Consumer Details: Click the link to go to more consumer details in the Consumers module or view the following:

- Name

- Phone Number

- Email Address

- Shipping Address

- Billing Address

- Last Four Digits of PAN

- Dispute Items: A detailed list of the item(s) under dispute.

- Name

- SKU

- Dispute Tax Amount

- Dispute Amount

- Discussion: Posts between the merchant and lender.

- To add a post, enter text in the Write here field and click the Send button.

- Attachments: Supporting documentation that has been added to the dispute.

- To upload an attachment, click the + under DISCUSSION.

- To download an attachment, click it.

- Timeline: Click the Timeline button to open a detailed timeline of dispute events.

Updated 6 months ago